As electric vehicles (EVs) gain momentum globally, battery technology is at the forefront of innovation. This wave of advancements in EV battery technology is driven by research into lithium-ion batteries, leading to breakthroughs in energy density, cost reduction, and sustainable materials. According to Goldman Sachs Research, these advancements are expected to make EVs more accessible, bringing ownership costs closer to parity with traditional gasoline-fueled cars. This could result in a projected 50% reduction in battery prices by 2026.

Lithium-Ion Batteries: Current Dominance and Advancements

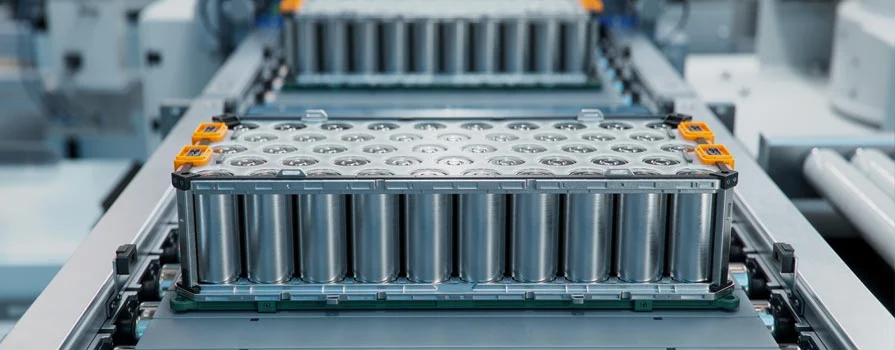

Today, lithium-ion batteries remain the backbone of EV battery technology. Known for their high energy per unit mass, power-to-weight ratio, and energy efficiency, lithium-ion batteries are widely used in everything from consumer electronics to electric cars. This popularity stems from their excellent high-temperature performance, long lifespan, and minimal self-discharge rate. While most components in lithium-ion batteries are recyclable, the cost of recovery remains a significant challenge, slowing the shift to more sustainable practices.

Lithium-ion batteries power nearly all electric vehicles and plug-in hybrid electric vehicles (PHEVs) today. However, the chemistry differs slightly from that used in smaller electronics, with EV batteries focusing more on durability and safety. Ongoing research seeks to further reduce lithium-ion battery costs, extend battery life, use less cobalt, and increase safety.

Why EV Battery Prices Are Declining Rapidly

The anticipated drop in EV battery prices can be attributed to two primary drivers: technological innovation and a decrease in metal prices. Innovations in EV car battery technology have significantly increased energy density, allowing battery manufacturers to simplify designs, save on production costs, and improve energy output. One prominent example is the shift to a cell-to-pack structure, which eliminates modules and consolidates cells directly into the pack. This streamlined approach saves space, reduces manufacturing complexity, and cuts costs, all while increasing energy density.

The second factor is the continued decline in green metal prices, particularly lithium and cobalt, which represent a substantial portion of battery costs. According to Goldman Sachs Research, metals account for nearly 60% of battery expenses, so the decrease in lithium and cobalt prices is set to further reduce the cost of batteries for electric cars. Goldman Sachs also reports that global average battery prices dropped from $153 per kilowatt-hour (kWh) in 2022 to $149 in 2023, with a projected decline to $111 per kWh by the end of this year. By 2026, the cost could reach $80 per kWh, which would make electric vehicle ownership cost-effective on an unsubsidized basis in the U.S.

Lithium-Based Batteries: The Leaders in EV Technology

The EV battery landscape is currently dominated by two types of lithium-based batteries: nickel-rich batteries and lithium ferrophosphate (LFP) batteries. Nickel-based batteries, which make up about 60% of the market, are known for their high energy density and long-range capability, making them ideal for performance-driven EVs. Meanwhile, LFP batteries, which are iron-based, capture about 35-40% of the market due to their affordability, stability, and environmental benefits, making them a popular choice for lower-cost EVs.

Although solid-state and sodium-ion batteries hold promise, they face challenges in scaling to mass production. Solid-state batteries could offer higher energy density and improved safety by eliminating the flammable liquid electrolyte used in traditional lithium-ion batteries. However, these innovations remain in the lab, with widespread production not expected until later in the decade. LFP batteries, in particular, are expected to continue growing in market share, reaching 45% by 2025, while nickel-based batteries maintain their lead in high-energy applications.

Impact of Falling Battery Prices on EV Demand

As battery prices decline, electric vehicle adoption is expected to surge. Lower costs mean that consumers can recover the price premium of an EV through fuel savings within a shorter period. This effect is amplified in the current high-oil-price environment, making EVs more economically attractive.

However, a recent analysis from Goldman Sachs Research suggests that potential EV buyers consider factors beyond fuel savings, such as the resale value of EVs. With rapid technological advancements and anticipated price reductions, some consumers may hesitate to purchase an EV now, anticipating more affordable options in the near future. Still, Goldman Sachs predicts that by 2026, the total cost of ownership parity will be achieved, independent of fuel savings. This milestone is expected to spark a consumer-led phase of EV adoption.

Entry Barriers and the Role of Incumbent Battery Producers

The EV battery industry has high entry barriers due to the extensive R&D and production expertise required to achieve cost-effective, quality battery manufacturing. Established battery producers, some of which have been in the industry for over two decades, dominate nearly 80% of the market. These companies have intensified their R&D investments in recent years, creating a competitive cycle that has made it difficult for new entrants to survive without achieving a high level of manufacturing efficiency.

For newer players entering the market during a cyclical downturn, the challenge is even more significant. Achieving profitability in this field can take a decade or more due to the high cost of R&D, quality control, and mass production. Finding skilled labor is another hurdle, as battery manufacturing requires highly specialized knowledge.

The Future of EV Battery Technology and Market Dynamics

While lithium-ion batteries remain the leading choice for electric vehicles, the next few years will likely bring advancements in solid-state and other alternative battery technologies. These technologies are expected to overcome existing limitations, such as energy density and safety concerns. However, until these newer technologies can scale for mass production, lithium-based batteries—particularly LFP and nickel-based variants—will continue to lead the market.

As the EV industry advances, innovations in battery design, combined with sustainable material sourcing and recycling, will play a vital role in reducing environmental impact. A significant aspect of future R&D will involve minimizing the reliance on scarce materials like cobalt and lithium, which are both expensive and associated with environmental and ethical concerns. The push for more sustainable, scalable battery options aligns with a broader trend toward green technology, offering both ecological and economic benefits.

A Transformational Decade for EV Battery Technology

The projected 50% reduction in electric vehicle battery prices by 2026 represents a turning point for the automotive industry. With advancements in energy density, simplified manufacturing processes, and declining raw material prices, EV battery technology is on a path to becoming more accessible, sustainable, and efficient.

These developments will not only make electric vehicles more affordable but also hasten their adoption worldwide. For decision-makers, the next few years represent a strategic window to invest in battery technology and EV infrastructure, positioning themselves to capitalize on an industry poised for exponential growth. According to insights from Goldman Sachs Research, the total cost of EV ownership could soon rival that of traditional gasoline cars, driving a consumer-led EV adoption surge.

As battery technology evolves, the global shift to electric vehicles will transform the automotive industry, reshape energy consumption, and pave the way for a more sustainable future. By focusing on the efficiency, scalability, and sustainability of EV car batteries, decision-makers can help usher in a new era of transportation—one that aligns with global goals for reduced emissions and a cleaner environment.